When I speak to FEA- or CFD-based simulator providers about the case for replatforming to an industrial-grade 3D visualization platform, I often hear a two-part response:

- Yes, it looks technically good and robust, but

- It will be tough to convince the CEO about its financial merits.

This is where a combination of Net Present Value (NPV) and qualitative analyses can be extremely useful. Today’s post shows how to perform them, what some of the pitfalls are, and how the question cannot be divorced from the long-term success of your company.

A NOTE: The exploration below relies on Ceetron’s work with CAE software providers of all sizes, ranging from the five-person niche provider to market majors with thousands of employees. Some of these companies have shared with us how they analyse platform replacement projects. It is fair to say that they use both NPV calculations and assessments of the five decision factors covered later in this post. For the small and medium-sized software providers, the third factor—reducing business risk—is often decisive. Such companies find it extremely difficult, if not impossible, to stay ahead of the technology development curve in 3D visualization.

Let’s look at the two basic approaches in a little more detail:

- Conducting an NPV analysis to provide quantitative reasoning for the C-suite.

- Conducting qualitative analysis examining what replatforming can do for your business—with a focus on reducing risk, enhancing technical standing, and building a reputation as a great place to work.

NPV Analytics. A framework like this is typically acceptable to the finance guys:

- Anchor your methodology (B – F, below), with your CFO, as he or she is the person to be convinced. Ensure that in compliance with existing project appraisal policies in the company.

- Establish a baseline for license revenues, maintenance costs, and support costs for existing offering without replatforming, over a 5-year time period.

- Conduct a workshop to estimate the following cost components:

-

- Cost of evaluation, estimated as effort estimate x hourly costs.

- Cost of replatforming project, estimated as effort estimate x hourly cost.

- Cost of release of new platform, incl. testing and marketing costs.

- Increase in short-term maintenance costs, reduction in longer-term maintenance costs.

- Increase in short-term support costs, reduction in longer-term maintenance costs.

- In same workshop, estimate also the following revenue components:

-

- Loss of revenues in interim period.

- Increase in longer-term revenues, prudently assessed.

- Estimate increase in royalty fees with new platform, if switching to a commercial platform.

- Calculate pre-tax or after-tax NPV, depending on company policy, using an appropriate discount rate.

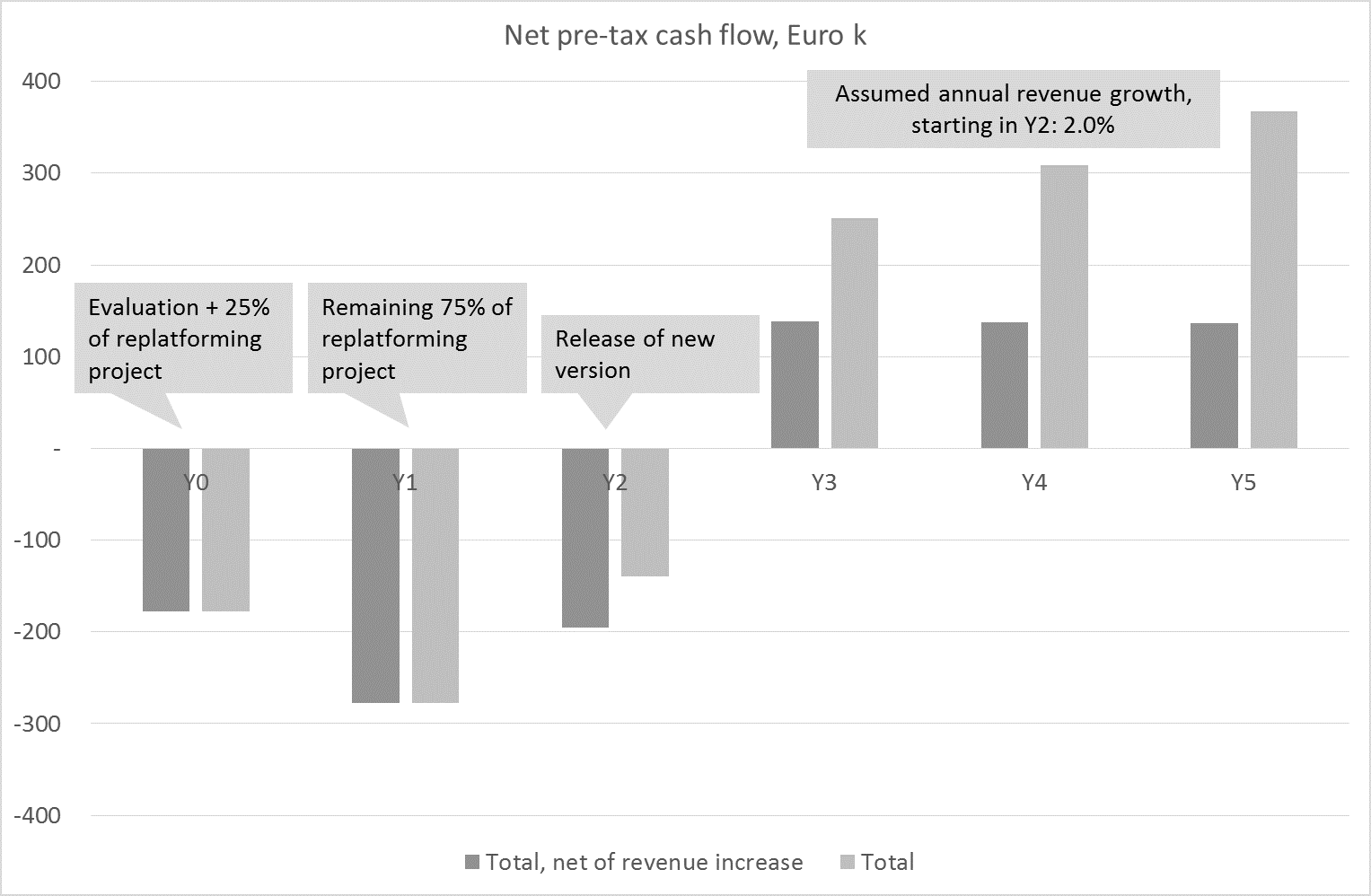

Such framework will typically give a net pre-tax cash flow profile (= cash flow with project – cash flow as is) as illustrated below (Euro 1 500k per year in license revenues and Euro 1 250k in support & maintenance revenues, which are typical numbers for main product line for many medium-sized CAE providers):

No big surprises here, and in many such replatforming cases based on B – F only, NPV, including revenue-side effects ≈ 0, and NPV, net of revenue-side effects < 0. This first analysis leads to the creation of the first divide. Good and well-intentioned software engineers feel they must make speculative revenue-side assumptions to justify their business cases. Good and well-intentioned CFOs respond with scepticism regarding input variables. The result is the highlighting of uncertainties that are so high, they make the replatforming decision almost impossible to make. But do these uncertainties reflect an underlying truth? That replatforming rarely makes sense? Clearly not.

Qualitative Analysis. So how do you answer the question: Should we replace our 3D visualization platform now or later? It is one of the biggest ones you face, so my advice is to properly weight the following five factors:

- Future Revenues: Many companies make neutral or optimistic assumptions when considering this issue. They propose that baseline revenues will remain flat or continue to grow at historical rates, regardless of the replatforming decision they’re about to make. In fact, it is far more rational to assume that the revenue baseline for a company with a static 3D visualization platform will go down. In the most general case, software offerings that do not improve in step with the market are seen as technically backward. In high-end arenas like 3D visualization, this is the kiss of death, and leads to a reputation for suspect performance (justified or not), and quickly abandonment by users who need the absolute best tools available. In order to avoid this analytical distortion, you must be as realistic about future revenues, which are obscure, as you are about future costs, which are plain to see. I am not suggesting that future revenues are guaranteed to decline. But history suggests they often do, and this kind of realism should inform your analysis of the crucial question: Is it possible to maintain current revenue levels with the existing platform?

- Programming Investment: The strategy of delaying software outlays is superficially attractive, but there is, of course, a catch. How do you time the replatforming effort so that you only invest in code once? If you make that choice now, you invest in new code for the new platform, and the costs are obvious—but you only have to incur them once. If you delay that choice, the catch emerges. You retain the old platform, you invest in old code—and you are still paying. Worse, when you do replatform, you will pay for programming it, too. In effect, you will pay twice for what the customer might see as the same offering.

- Business Risk. When you switch to a commercial 3D visualization platform, you receive obvious proximate benefits: better quality code, better performance, professional support, and even professional services to shape the offering to your particular requirements. But the biggest benefit is actually not listed on the product sheets and brochures: you benefit from greatly reduced business risk. There is a significant difference in code quality between a home-grown solution and a commercial third party solution. This code quality improvement contribute to less support, easier maintenance, and more satisfied customers. Similar arguments can be made about the creation and capturing of value from performance, support, and professional services, in the form of lower costs, higher revenues, or reduced risk, for you and for your clients.

- Access to Engineering Talent: In software, you have to have great engineers to build a great company, ipso facto. And in almost every imaginable case, good engineers want to work with new technology. Old technology might not guarantee that good engineers go elsewhere, but it is not a point in your favor.

- Leverage. Most important, consider how replatforming gives you the option to leverage new technologies. We are in the midst of two revolutions: How to create, and how to deliver, typical CAE applications for an incredible range of platforms. The functions that used to rely on standalone engineering workstations are starting to be ported to environments on mobile devices, SaaS platforms, the cloud, and Web 3.0 technologies. I believe that the winners of tomorrow will be not those who reduce near-term costs, but those who are positioned to leverage these new technologies. In this context, the benefits of switching to a modern visualization platform are clear.

You may not be able to assign monetary values to the above five bullet points, but the core of the strategy is that a thorough assessment of these benefit areas will allow you to credibly fill the gap between NPV < 0 and NPV > 0. The strategy of introducing speculative revenue-side assumptions will give you no such ability.

Tor Helge (with some input from my colleagues)

Leave A Comment

You must be logged in to post a comment.